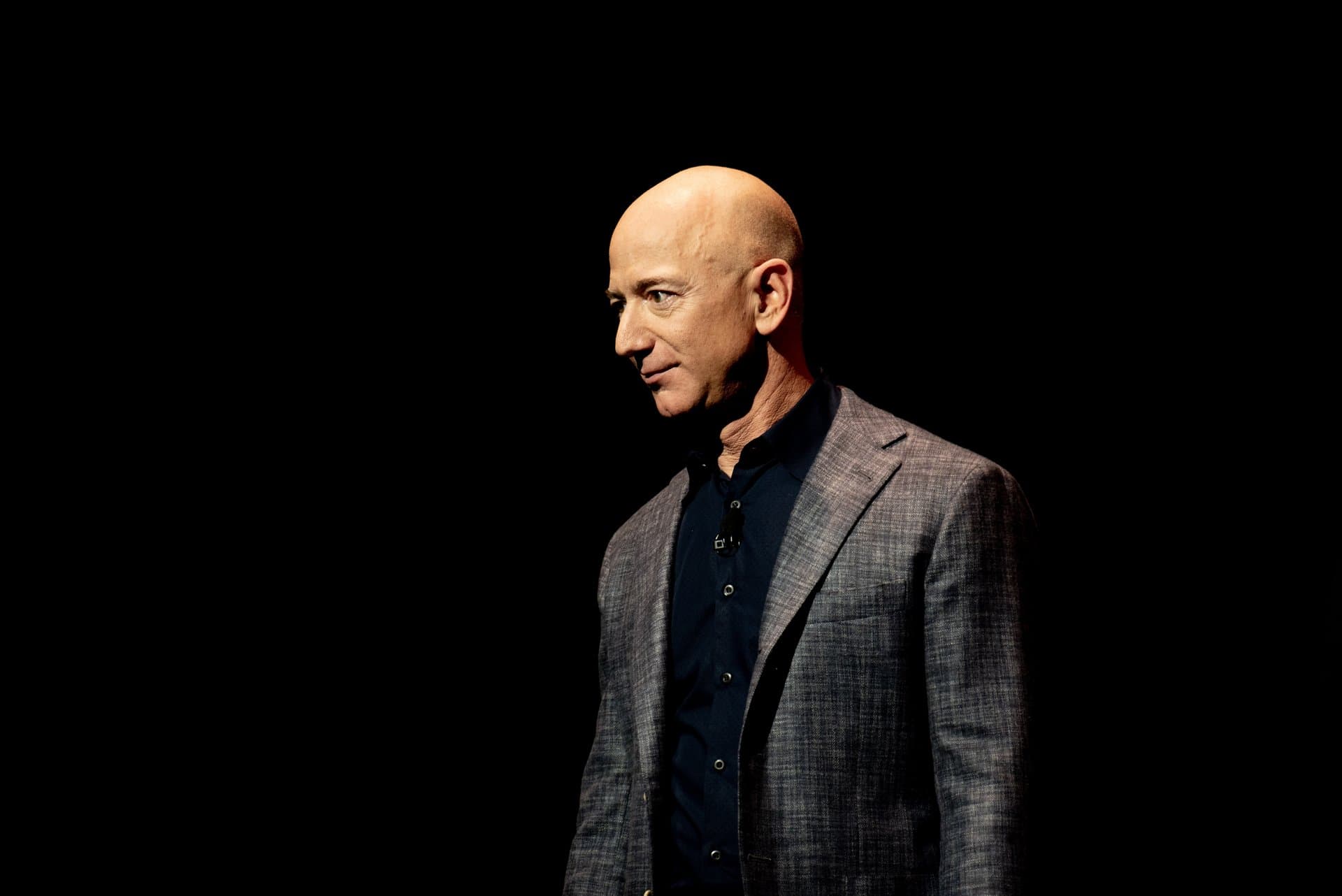

Bezos-Backed Renewables Alliance Drives $7.5B Clean Energy Push

Discover how the Bezos Earth Fund and partners are mobilizing $7.5 billion to transform energy access and cut emissions in developing countries through innovative renewable investments.

Key Takeaways

- GEAPP aims to invest $7.5 billion in clean energy by 2030

- 750 million people lack electricity access globally

- Energy-poor countries contribute 25% of emissions, potentially 75% by 2050

- Catalytic capital unlocks private and public funding

- Digital grids and battery storage are key focus areas

- Just transition supports fossil fuel workers and equity

Imagine a world where clean energy lights up homes and powers economies in places long left in the dark. That’s the vision driving the Global Energy Alliance for People and Planet (GEAPP), a powerhouse coalition co-founded by the Bezos Earth Fund, Rockefeller Foundation, and IKEA Foundation. With a bold target to mobilize $7.5 billion over five years, this alliance is tackling energy poverty head-on while slashing carbon emissions.

Energy poverty isn’t just a statistic—it’s a barrier to progress for over 750 million people without electricity and 1.6 billion with unreliable power. These regions currently emit only a quarter of global CO2 but risk becoming the majority source by 2050 without urgent action. GEAPP’s strategy blends catalytic philanthropy, innovative finance, and digital technology to rewrite this story.

In this article, we’ll unpack how the Bezos-backed renewables alliance is reshaping energy access, the innovative financial tools powering this transformation, and why this matters not just for climate goals but for millions seeking a brighter future.

Addressing Energy Poverty

Energy poverty is a stubborn shadow over much of the developing world. Over 750 million people live without electricity, and another 1.6 billion endure unreliable or costly power. Imagine trying to study, cook, or run a business without steady energy—it's a daily struggle that stalls progress.

GEAPP steps into this gap with a mission to flip the script. These energy-poor countries currently contribute only 25% of global CO2 emissions, but that share could balloon to 75% by 2050 if clean energy doesn’t reach them fast. The stakes are high—not just for climate but for human development.

What’s striking is the funding mismatch: these regions receive just 13% of global clean energy financing. GEAPP’s $7.5 billion target aims to close this gap, lighting up homes and economies while cutting emissions. It’s a reminder that climate solutions must be inclusive, or they risk leaving billions behind.

Mobilizing Catalytic Capital

Think of catalytic capital as the spark that ignites a wildfire of investment. GEAPP uses philanthropic grants to reduce risks, attracting private and public money that might otherwise stay on the sidelines. This approach is crucial as traditional government aid shrinks—official development aid fell 7.1% in 2024, led by U.S. cuts.

By leveraging $500 million in philanthropic funds to unlock $7.5 billion, GEAPP multiplies impact fifteenfold. This isn’t charity—it’s smart finance designed to shift markets. Programs like Nigeria’s Demand Aggregation for Renewable Technology (DART) bundle orders to cut solar and battery costs by 10-20%, making clean tech more affordable and scalable.

This blend of risk-tolerant capital and market savvy challenges the myth that green energy in developing countries is too risky or expensive. GEAPP proves that with the right financial tools, clean energy investments can thrive.

Building Digital, Renewables-Ready Grids

Modern energy systems are more than wires and poles—they’re digital ecosystems. GEAPP’s vision of "Grids of the Future" means power networks that are smart, flexible, and ready for renewables. In Jaipur, India, a live digital map tracks 6.5 million utility assets, spotting issues before outages happen and saving $50 million annually.

This isn’t just tech for tech’s sake. Digitizing grids across Asia, Africa, Latin America, and the Caribbean creates a backbone for reliable, affordable clean energy. Battery storage projects in over 20 countries, including India’s first standalone utility-scale system, smooth out renewable supply and boost resilience.

By scaling these innovations across multiple utilities worldwide, GEAPP is rewriting the rulebook on energy infrastructure. It’s a vivid example of how technology and finance can join forces to power a cleaner, smarter future.

Championing Just Energy Transitions

Transitioning to clean energy isn’t just about technology—it’s about people. GEAPP recognizes that fossil fuel workers and communities can’t be left behind. Programs retrain workers, especially in coal-heavy regions like South Africa’s Mpumalanga province, ensuring new green jobs replace old ones.

This focus on equity and inclusion challenges the myth that climate action sacrifices livelihoods. Instead, it creates opportunities for economic growth, gender equity, and social justice. The alliance’s Energy and Opportunity Coalition aims to embed green energy in sectors like agriculture and health, broadening impact beyond power generation.

By weaving social justice into its strategy, GEAPP ensures the energy transition is fair and sustainable, lighting a path that benefits everyone, not just the planet.

Leveraging Global Partnerships

No giant moves alone. GEAPP’s strength lies in its diverse partners—from the Bezos Earth Fund and IKEA Foundation to governments like Britain and Denmark, the World Bank, and private firms like GE Vernova. This coalition blends philanthropy, policy, and private sector muscle.

Collaborations with the U.S. Department of State and the World Bank’s SCALE initiative bring innovative carbon credit models and policy support to developing countries. These efforts align private capital with verified emissions reductions, creating new revenue streams for green projects.

Such partnerships debunk the myth that climate finance is fragmented or ineffective. Instead, they show how coordinated action can unlock billions, drive systemic change, and deliver clean energy to millions.

Long Story Short

The Bezos-backed Global Energy Alliance for People and Planet is more than a funding initiative—it’s a lifeline for billions trapped in energy poverty and a blueprint for systemic change. By mobilizing $7.5 billion through catalytic capital and partnerships, GEAPP is proving that clean energy can be affordable, accessible, and equitable. This alliance’s focus on digital, renewables-ready grids and just transitions ensures that the shift to green energy leaves no one behind. The relief of reliable power, new jobs, and cleaner air is within reach, but only with continued innovation and collaboration. For investors, policymakers, and citizens alike, GEAPP’s journey offers actionable insights: blending philanthropy with private capital, embracing technology, and centering social justice can unlock a sustainable energy future. The clock is ticking, but with bold moves like these, the light at the end of the tunnel is growing brighter.