Commonwealth Fusion Systems’ $1B+ Fusion Power Deal Sparks Energy Shift

Discover how Commonwealth Fusion Systems’ $1 billion+ power agreement with Eni propels fusion energy from theory to grid-scale reality, reshaping clean power’s future with Arc’s 400MW fusion reactor.

Key Takeaways

- CFS secures $1B+ power deal with Eni for fusion electricity

- Arc reactor aims for 400MW output by early 2030s

- Google also committed to buying half of Arc’s power

- Sparc demonstration reactor 65% complete, targeting 2026 startup

- Fusion power agreements balance risk with collaborative terms

Imagine a world where the sun’s power is harnessed on Earth, delivering clean, abundant energy. Commonwealth Fusion Systems (CFS) is turning that vision into a tangible future with a landmark $1 billion-plus power purchase agreement with Italian energy giant Eni. This deal marks a pivotal moment, moving fusion energy from experimental labs toward real-world electricity grids.

Set to build the 400-megawatt Arc fusion reactor near Richmond, Virginia, CFS is positioning itself at the forefront of clean energy innovation. Alongside Google’s commitment to buy half of Arc’s output, these agreements signal growing confidence in fusion’s potential to power data centers and beyond.

This article unpacks the significance of CFS’s fusion power deal, explores the technology behind Arc, and examines the challenges and opportunities shaping fusion’s commercial dawn. Ready to dive into the future of energy? Let’s explore how fusion is rewriting the rules of power generation.

Securing Fusion Power Deals

Locking in a $1 billion-plus power purchase agreement with Eni is no small feat. It signals that fusion energy, long a scientific dream, is gaining serious commercial traction. Eni, a global energy giant, is betting on CFS’s Arc reactor to deliver clean electricity by the early 2030s. This deal isn’t just about buying power—it’s about setting a price benchmark for fusion energy’s future.

Google’s parallel agreement to buy half of Arc’s output adds another layer of credibility. Their interest ties fusion power directly to the surging energy needs of data centers, especially those supporting AI and cloud computing. It’s a strategic move, aligning fusion’s promise with real-world demand.

But what if the reactors face delays or technical hurdles? CFS’s CEO Bob Mumgaard explains that the agreements are designed to balance risk and collaboration. Partners understand the challenges of pioneering a new industry. This isn’t a typical power deal where failure means walking away; it’s a partnership built on shared ambition and patience.

Building the Arc Reactor

Arc is envisioned as a 400-megawatt fusion reactor, enough to power a sizable metropolitan area or clusters of energy-hungry data centers. Its location near Richmond, Virginia, is no accident—this region hosts some of the densest data center concentrations in the U.S., making it a perfect match for Arc’s output.

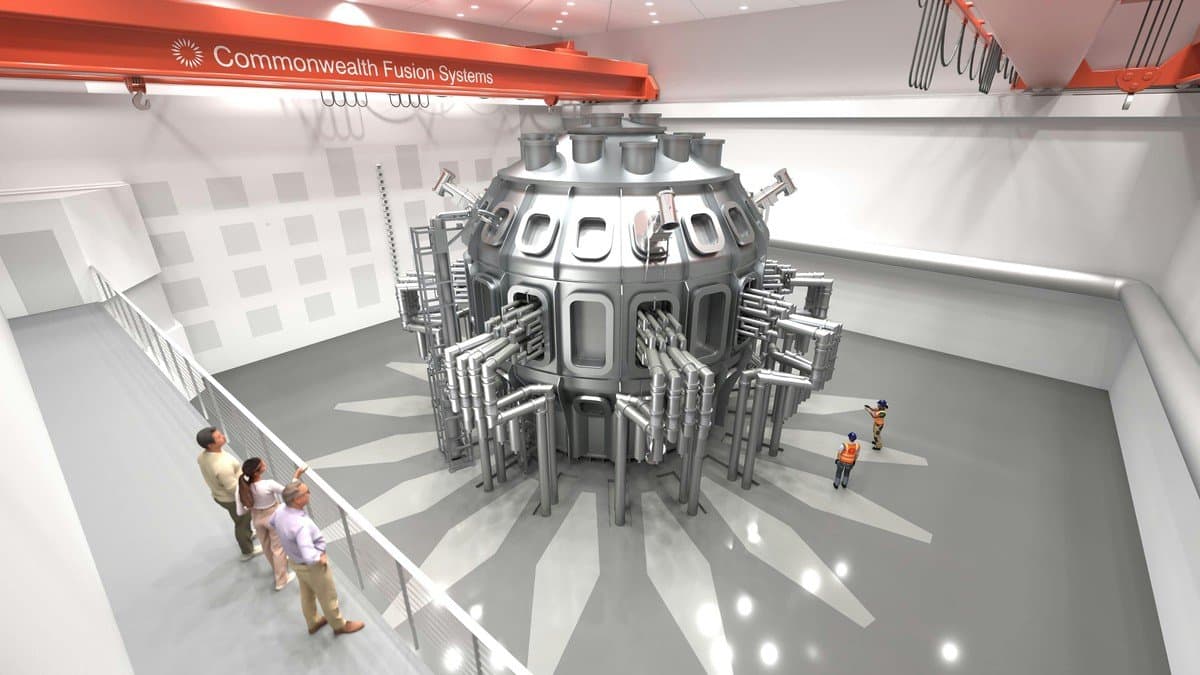

The technology behind Arc builds on the tokamak design, which uses powerful D-shaped superconducting magnets to confine and compress plasma. Inside this plasma, atomic nuclei collide and fuse, releasing vast amounts of energy. This approach aims to achieve net energy gain, where the reactor produces more power than it consumes.

CFS is leveraging lessons from its Sparc demonstration reactor, currently 65% complete and scheduled to start in 2026. Sparc serves as a nearly full-scale testbed to refine construction, operation, and supply chain logistics. The experience gained here will pave the way for Arc and future reactors to be built at scale.

Navigating Fusion’s Financial Landscape

Raising nearly $3 billion to date, including an $863 million Series B2 round featuring investors like Nvidia, Google, and Eni, CFS is fueling its ambitious fusion roadmap. These funds are essential to push Sparc to completion and prepare for Arc’s construction.

Yet, fusion’s financial journey is complex. Early fusion electricity will be expensive, and Eni expects to resell power on the grid, likely at a loss initially. This deal isn’t about immediate profits but about establishing fusion’s market value and attracting further investment.

The power purchase agreements provide certainty on pricing and delivery, crucial for securing project financing. They act as a foundation to engage more financial investors and government programs, smoothing fusion’s path from demonstration to commercial deployment.

Challenging Fusion Myths

Fusion energy often gets dismissed as perpetually ‘30 years away,’ a myth rooted in decades of technical hurdles. CFS’s progress challenges this narrative by turning fusion from a distant dream into a near-term project with concrete timelines.

Another myth is that fusion will be prohibitively expensive forever. While early fusion power will carry a premium, deals like Eni’s and Google’s show industry players are willing to invest in fusion’s potential. The goal is to build a supply chain and scale production, which historically drives costs down.

Finally, the idea that fusion is a solo race is debunked by CFS’s collaborative approach. Investors, energy companies, tech giants, and government agencies are all part of this ecosystem, sharing risks and rewards. Fusion’s future is a team sport, not a lone endeavor.

Fusion’s Role in Energy’s Future

Fusion promises zero-carbon, firm base-load power, a holy grail for decarbonization efforts worldwide. As countries and companies race toward net-zero emissions, fusion offers a clean alternative to fossil fuels and complements intermittent renewables.

The involvement of hyperscale cloud providers like Google highlights fusion’s role in powering the digital economy. Data centers demand reliable, massive electricity supplies, and fusion’s potential to meet this need is a game changer.

Government backing, including U.S. Department of Energy programs, further cements fusion’s strategic importance. While challenges remain, fusion’s commercial dawn is breaking, promising to reshape how we power our lives and planet in the decades ahead.

Long Story Short

The $1 billion-plus power deal between Commonwealth Fusion Systems and Eni is more than a contract—it’s a beacon lighting the path from fusion’s scientific promise to commercial reality. With Arc’s 400MW fusion reactor slated for the early 2030s, backed by heavyweights like Google and Eni, fusion energy is stepping out of the shadows of theory and into the spotlight of practical, clean power. Yet, the journey is far from guaranteed. Sparc’s demonstration reactor will be the critical test, and the road ahead demands patience, innovation, and collaboration. The agreements’ flexible terms reflect a shared understanding that pioneering new technology is a marathon, not a sprint. For investors, energy companies, and tech giants alike, this fusion milestone offers a fresh lens on what’s possible. The relief of a future powered by carbon-free fusion energy is within sight, promising to reshape how we fuel our digital lives and planet. Stay tuned—fusion’s revolution is just beginning.