Navigating China’s Rare Earth Export Controls: 5 Critical Insights

Explore how China’s rare earth export restrictions impact global industries, the risks for U.S. manufacturers, and actionable strategies to reduce dependency on this vital supply chain.

Key Takeaways

- China demands sensitive data for rare earth export licenses

- Export licenses now limited to six months, causing supply uncertainty

- Rare earth shortages threaten auto and tech manufacturing globally

- China controls about 70% of mining and 90% of refining rare earths

- US companies hold only 2-3 months of rare earth inventory

Imagine a world where the tiny metals powering your electric car, smartphone, and even medical devices suddenly become scarce. That’s the reality as China tightens its grip on rare earth exports, demanding sensitive business information and slashing export license durations to six months. These moves have rattled Western companies and sparked fears of a supply crisis reminiscent of the pandemic-era chip shortage. With China mining 70% and refining 90% of these critical minerals, the stakes couldn’t be higher. This article unpacks five critical insights into China’s rare earth export controls, their ripple effects on global industries, and what companies and governments are doing to navigate this high-stakes landscape.

Demanding Sensitive Data

China’s recent policy shift has Western companies on edge. Export licenses for rare earth elements now come with strings attached—companies must hand over sensitive business information, including detailed production data and customer lists. This isn’t just paperwork; it’s a potential gateway for intellectual property risks and increased Chinese leverage over foreign firms. Imagine running a business where your trade secrets are collateral for access to essential materials. The Chinese Ministry of Commerce’s demands align with a broader strategy to tighten control over the rare earth supply chain, crucial for everything from electric vehicles to defense tech.

This move raises the stakes beyond economics into geopolitics. Companies worry that sharing such data could lead to competitive disadvantages or political pressure. It’s a reminder that in global trade, information can be as valuable as the minerals themselves. For Western firms, this means navigating a minefield of compliance and risk, balancing the need for rare earths against protecting their core business intelligence.

Short-Term Export Licensing

Since April 2025, China has imposed a six-month limit on rare earth export licenses, a sharp departure from previous longer-term arrangements. This short-term licensing injects uncertainty into supply chains, making it difficult for companies to plan production and inventory. Imagine trying to build a car or smartphone when your key materials’ availability is a moving target every half-year.

The Wall Street Journal reports that this licensing cap affects major U.S. automakers and manufacturers, forcing them to scramble for temporary permits. Even when licenses are granted, the flow of rare earths isn’t matching past levels, slowing shipments and tightening inventories. This unpredictability is a headache for industries already stretched thin by pandemic-era disruptions. The six-month window feels like a ticking clock, pressuring companies to hedge bets or face costly shutdowns.

Supply Chain Vulnerabilities

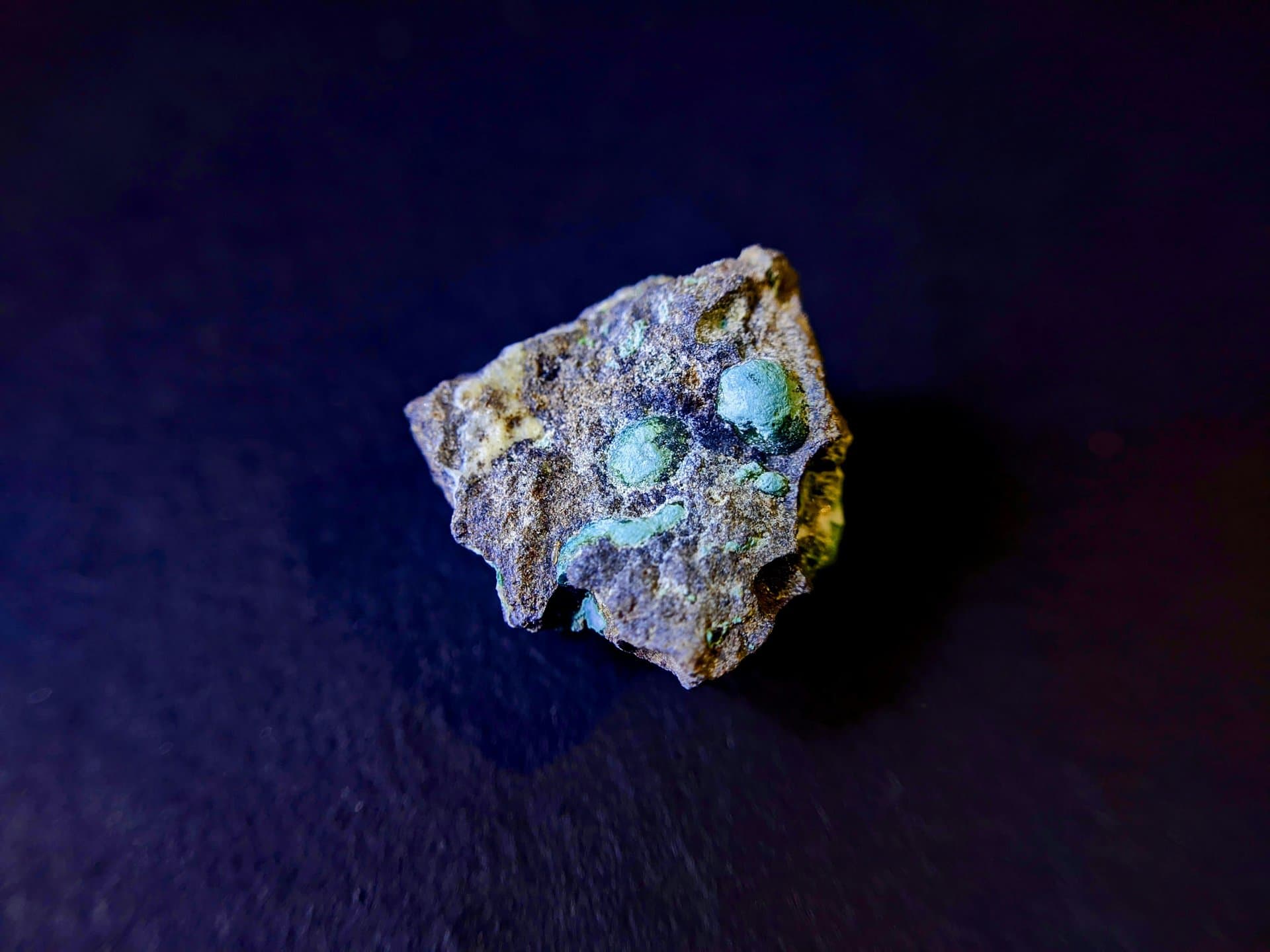

Rare earth elements are the unsung heroes behind modern technology, powering electric motors, sensors, and even medical devices. China’s dominance is staggering: it mines about 70% of these minerals and refines roughly 90%, effectively controlling the global supply chain. This near-monopoly means that any disruption in China’s policies reverberates worldwide.

Industry experts liken the current shortage to a “chip shortage on steroids,” highlighting the severity of potential disruptions. The automotive sector is particularly vulnerable, with rare earth magnets embedded in motors, windshield wipers, and seat belt sensors. Ford’s week-long production halt at its Chicago plant underscores the real-world impact. With U.S. companies holding only two to three months of rare earth stockpiles, the clock is ticking. Without a stable supply, manufacturing lines risk grinding to a halt, echoing the painful lessons of past shortages.

Geopolitical Trade Dynamics

Rare earths have become a chess piece in the ongoing U.S.-China trade conflict. China frames its export restrictions as national security measures, citing the dual-use nature of these minerals in both civilian and military applications. This justification adds a layer of complexity to trade negotiations, which have unfolded in high-profile meetings in London and Geneva.

Despite some announcements hinting at eased tensions, details remain vague, and companies remain cautious. The rare earth sector is caught in a broader geopolitical tug-of-war, where trade policy and security concerns intertwine. For U.S. manufacturers, this means navigating not just market forces but also diplomatic currents. The stakes are high—rare earths are not just commodities but strategic assets shaping global power balances.

Seeking Alternatives and Solutions

Facing China’s tightening grip, U.S. industries and governments are racing to find alternatives. Research into substitute materials, such as magnets and motors that don’t rely on rare earths, is underway. However, experts warn these alternatives come with trade-offs, often sacrificing performance and efficiency.

Building domestic processing capabilities is another critical front, but it’s a long game—establishing facilities and supply chains takes months or years. Meanwhile, companies scramble to stretch limited inventories and hope for stable trade agreements. The consensus among experts is clear: the best hope to avoid severe disruptions lies in a durable U.S.-China deal restoring reliable rare earth flows. Until then, the rare earth saga remains a high-stakes balancing act between dependency and innovation.

Long Story Short

China’s tightening control over rare earth exports is more than a trade tactic—it’s a strategic chokehold on industries vital to modern life. The demand for sensitive data, coupled with short-term export licenses, has thrown supply chains into turmoil, especially for U.S. automakers and tech manufacturers. The looming shortage, dubbed a “chip shortage on steroids,” threatens widespread production halts and soaring costs. While talks between the U.S. and China offer a glimmer of hope, the reality is clear: dependency on China’s rare earth dominance is a risky bet. Companies and governments must accelerate efforts to diversify sources, develop alternative materials, and build domestic processing capabilities. The road ahead demands vigilance, innovation, and a readiness to adapt—because when rare earths tighten, industries feel the squeeze.