Powell’s Fed Strategy: Navigating Rate Cuts Without Autopilot

Explore how Fed Chair Jerome Powell’s data-driven approach challenges market myths about automatic rate cuts, offering investors fresh insights into the Fed’s cautious path amid economic uncertainty.

Key Takeaways

- Powell rejects the myth of a Fed on autopilot, emphasizing data-driven decisions.

- September 2024’s rate cut was a cautious risk management move, not a signal of ongoing easing.

- Economic data uncertainty, especially amid a government shutdown, complicates Fed policy choices.

- Markets often misinterpret Fed signals, expecting automatic rate cuts that may not materialize.

- Investors should focus on evolving data and Fed communication nuances rather than preset expectations.

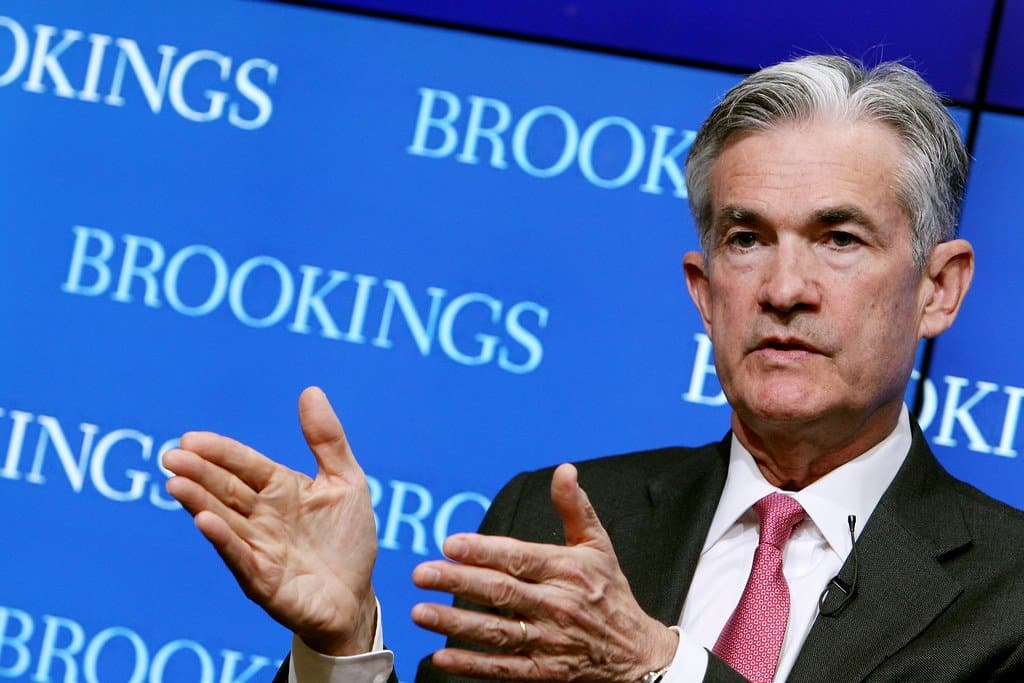

Jerome Powell’s Federal Reserve is steering clear of the autopilot myth that markets often cling to. After the September 2024 rate cut, many expected a smooth path of further reductions. Powell, however, made it clear that the next move isn’t locked in and depends heavily on fresh economic data. This cautious stance reflects a balancing act amid uncertain labor market signals and inflation risks.

The Fed’s approach under Powell is less about following a script and more about reading the economic tea leaves — even when those leaves are obscured by a government shutdown. Investors who assume a mechanical sequence of rate cuts risk being blindsided by the Fed’s flexible, data-dependent strategy.

In this article, we unpack Powell’s challenge to the autopilot narrative, explore the economic context behind recent rate decisions, and offer actionable insights for investors navigating this foggy terrain.

Rejecting the Autopilot Myth

Imagine expecting your GPS to take you straight home, only to find roadblocks and detours. That’s the market’s autopilot myth about the Fed — assuming once Powell signals a rate cut, a smooth ride of cuts follows. Powell shattered this illusion by stressing that each decision is made fresh at every meeting, not on a preset schedule.

The September 2024 quarter-point cut was labeled a “risk management cut,” a preemptive shield against labor market softness, not the start of a rate-cut parade. This distinction is crucial. Markets often leap ahead, pricing in multiple cuts, but Powell’s words remind us the Fed isn’t on cruise control.

This approach keeps the Fed nimble, able to respond to surprises rather than sticking to a script. It’s like driving cautiously through fog — you don’t speed up just because you want to reach your destination faster. Powell’s Fed is all about flexibility, not autopilot.

Navigating Economic Uncertainty

The U.S. economy is in a curious dance. Powell described it as balanced yet fragile, with both labor demand and supply slipping unexpectedly. Despite these shifts, the economy’s foundation remains solid, and unemployment forecasts for 2025 hold steady.

This delicate balance complicates the Fed’s choices. The rate cut was a nod to downside labor risks, but not a signal to ease aggressively. Think of it as adjusting your sails in shifting winds — cautious tweaks rather than a full course change.

Adding to the challenge is a government shutdown causing a data blackout. Without fresh economic numbers, the Fed must rely on alternative signals, making the path ahead even murkier. Powell’s metaphor of driving in fog captures this perfectly: slow down, stay alert, but don’t slam the brakes or floor the gas.

Decoding Market Expectations

Markets love certainty, especially when it comes to Fed moves. The autopilot myth feeds on this craving, leading traders to price in a series of rate cuts after a single move. But Powell’s recent remarks sent a jolt, reminding investors that a December cut isn’t guaranteed — “not a foregone conclusion,” as he put it.

This warning rattled markets briefly, with stocks dipping and Treasury yields spiking before settling. It revealed a gap between Wall Street’s hopes and the Fed’s cautious reality. The takeaway? Don’t bet on a smooth, predictable Fed path.

Investors should tune into the Fed’s nuanced language and evolving data rather than relying on dot plots or market whispers. Powell’s Fed is less about following a script and more about reading the room — a subtle but vital difference.

Understanding Fed’s Internal Divergence

Inside the Fed, not everyone sings from the same hymn sheet. Powell acknowledged “strongly differing views” among his colleagues about the future path of rates. Some lean toward further easing, others urge caution.

This internal tension reflects the complexity of balancing inflation risks against labor market softness. The Fed’s dot plot shows a dovish tilt, but growth and inflation projections remain hawkish. It’s like a team debating whether to press forward or hold back — no easy answers.

For investors, this means the Fed’s next moves are not set in stone. The mix of opinions and data fog demands patience and attention to subtle shifts in Fed communication.

Investing Amid Fed Flexibility

Powell’s rejection of autopilot has real-world implications for investors. Historically, non-recessionary easing cycles — where the Fed lowers rates without an economic downturn — have been good for stocks and high-yield bonds, with gold also gaining, though less dramatically.

But the key is to watch the data, not the calendar. The Fed’s moves hinge on actual economic developments, especially labor market trends, rather than a predetermined sequence.

This means investors should stay alert to Fed signals and economic reports, ready to adjust strategies as the story unfolds. Flexibility and vigilance beat assumptions in this foggy landscape.

Long Story Short

Jerome Powell’s Fed is rewriting the script on monetary policy by rejecting the autopilot myth. This isn’t a Fed that marches to a preset beat; it’s a Fed that listens, watches, and adapts. The September 2024 rate cut was a strategic, cautious move — a risk management step rather than a green light for a series of cuts. For investors, this means the road ahead is less predictable but more grounded in real economic signals. The Fed’s emphasis on data dependency, especially amid uncertain labor market trends and inflation risks, calls for vigilance and flexibility. Watching the Fed’s tone and economic indicators will be key to staying ahead. Ultimately, Powell’s approach offers a refreshing reminder: in finance, as in life, the best plans are those that adapt to the unexpected. Embrace the uncertainty, and let the data guide your next move.