Unveiling Jeff Bezos’ Family Office: Facts Behind the Billionaire Legacy

Explore the real story of Jeff Bezos’ family office expansion, debunk myths about his biological father, and discover how Aurora Borealis steers a $40 billion fortune with savvy leadership and growth.

Key Takeaways

- Aurora Borealis is expanding to manage over $40 billion in Bezos family wealth.

- Mike Bezos, Jeff’s stepfather, leads the family office, not Jeff’s biological father.

- Valeria Alberola was hired as CEO to oversee the growing family office.

- Family offices are booming globally, reflecting rapid wealth accumulation and transfers.

- Misconceptions about Jeff Bezos’ biological father’s role in wealth management are unfounded.

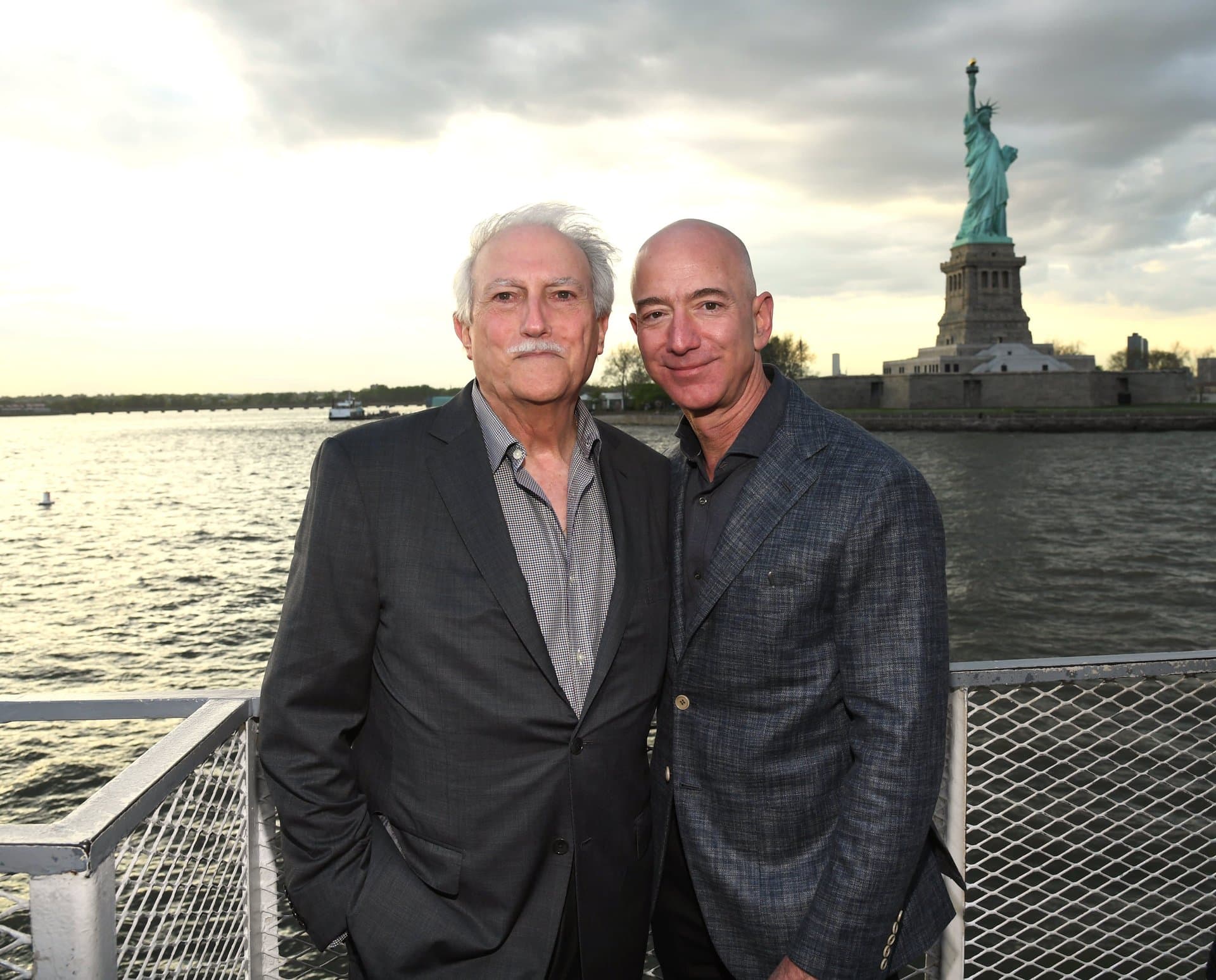

When it comes to the Bezos family fortune, stories swirl as fast as the wealth itself. But behind the headlines lies a clear narrative: Mike Bezos, Jeff’s stepfather, is spearheading a major expansion of their family office, Aurora Borealis, to steward a fortune estimated at over $40 billion. This isn’t just about money—it’s about legacy, leadership, and the next generations stepping up.

Contrary to some myths, Jeff Bezos’ biological father, Ted Jorgensen, lived a modest life and had no role in managing the Bezos fortune or family office. Instead, the family’s wealth management is a carefully orchestrated effort involving seasoned executives like Valeria Alberola, recently appointed CEO, who brings experience from other billionaire family offices.

In this article, we’ll unpack the real story behind the Bezos family office expansion, demystify common misconceptions, and explore what this means for ultra-wealthy families navigating the complex world of wealth stewardship today.

Expanding Aurora Borealis

Imagine a family office that started small in 2020, quietly managing the Bezos family’s wealth. Now, it’s undergoing a major expansion to support multiple generations and a fortune north of $40 billion. That’s Aurora Borealis, the family office led by Mike Bezos, Jeff’s stepfather. The office recently brought on Valeria Alberola as CEO, a seasoned executive with a track record managing investments and philanthropy for the Waltons.

This expansion isn’t just about adding staff—it’s about evolving the family’s financial command center. The plan includes hiring a chief investment officer to oversee a diverse portfolio that stretches beyond Amazon stock into alternative investments and trusts. It’s a strategic move to safeguard and grow wealth amid shifting markets.

Aurora Borealis reflects a broader trend: family offices worldwide are booming. Deloitte reports over 8,000 single-family offices exist today, a 31% jump since 2019, with projections soaring to over 10,700 by 2030. The Bezos family is riding this wave, turning their family office into a powerhouse for managing legacy and impact.

Debunking the Billionaire Dad Myth

Here’s where the story gets tangled. Some headlines claim Jeff Bezos’ biological father, Ted Jorgensen, is behind the family office expansion. That’s simply not true. Ted Jorgensen, who passed away in 2015, lived a modest life as a bicycle shop owner and had little contact with Jeff after his parents separated.

The real financial backbone comes from Mike Bezos, Jeff’s Cuban immigrant stepfather, who adopted Jeff and invested in Amazon’s early days. Mike and Jeff’s mother, Jacklyn, built their wealth through smart investments and philanthropy, including gifts of stock in companies like Uber and Facebook.

This myth highlights how easy it is for financial narratives to get distorted. The Bezos family’s wealth management is a product of decades of strategic decisions by Mike and Jacklyn Bezos, not Ted Jorgensen. It’s a reminder to look beyond catchy headlines and seek the facts.

Leadership Driving Growth

Valeria Alberola’s arrival as CEO marks a new chapter for Aurora Borealis. With an MBA from Northwestern’s Kellogg School and experience managing the Waltons’ investments, she’s no stranger to the high-stakes world of family offices. Her role is to oversee day-to-day operations and guide the family’s expanding portfolio.

The family office’s growth means more than just managing stocks—it involves coordinating trusts, foundations, and alternative assets. The CIO, soon to be hired, will work alongside Alberola to diversify holdings and ensure the family’s wealth adapts to changing economic landscapes.

This leadership duo reflects a trend where family offices hire top-tier talent to professionalize wealth stewardship. It’s about blending family values with financial expertise to secure a lasting legacy.

Navigating Wealth Transfer

One of the biggest challenges for ultra-wealthy families is passing the baton smoothly. Aurora Borealis is gearing up to support the second and third generations of the Bezos family, known as G2 and G3. This means not just preserving wealth but educating heirs and aligning investments with their values.

The Bezos Family Foundation, co-founded by Mike and Jacklyn, focuses on educational philanthropy, showing how wealth can fuel purpose beyond dollars. Meanwhile, family members like Mark Bezos are involved in ventures and philanthropy, indicating a diverse approach to legacy.

This phase of wealth transfer is critical. It requires balancing growth, risk, and family harmony. Aurora Borealis’ expansion and professional leadership are designed to meet these complex demands head-on.

The Rise of Family Offices

Family offices like Aurora Borealis are no longer niche players. Deloitte’s data shows a 31% increase in single-family offices worldwide since 2019, with numbers expected to hit over 10,700 by 2030. This surge mirrors the fastest wealth accumulation since the Gilded Age.

Why the boom? Wealth transfer from baby boomers to younger generations is a big driver, alongside entrepreneurial ventures creating new fortunes. Family offices offer tailored services—from investment management to legal and concierge support—making them a one-stop shop for ultra-wealthy families.

For Wall Street and Silicon Valley, family offices are prized partners. Unlike public pensions, many family offices have room to invest in alternatives, providing stable, growing capital. Aurora Borealis fits this mold, evolving to meet the demands of a new era in wealth stewardship.

Long Story Short

The Bezos family’s journey with Aurora Borealis offers a masterclass in how ultra-wealthy families evolve their wealth management across generations. Mike Bezos’ leadership and the strategic hiring of executives like Valeria Alberola signal a commitment to professional stewardship and diversification beyond Amazon’s shadow. Dispelling myths about Jeff Bezos’ biological father reminds us how narratives can drift from facts, especially in the world of high finance and fame. The real story is one of thoughtful growth, philanthropy, and preparing the second and third generations to carry the torch. For families navigating their own wealth journeys, the Bezos example underscores the importance of clear governance, expert leadership, and embracing change. The future of family offices like Aurora Borealis is not just about preserving billions—it’s about crafting enduring legacies with heart and precision.